Written to help you do a better job of managing your personal and family financial affairs and to help you get more for your money. You get ideas on saving, investing, cutting taxes, making major purchases, advancing your career, buying a home, paying for education, health care and travel, plus much, much more. Special issues cover the latest information about car buying (December) and Mutual Funds (March and September).

Medicare Can Wait

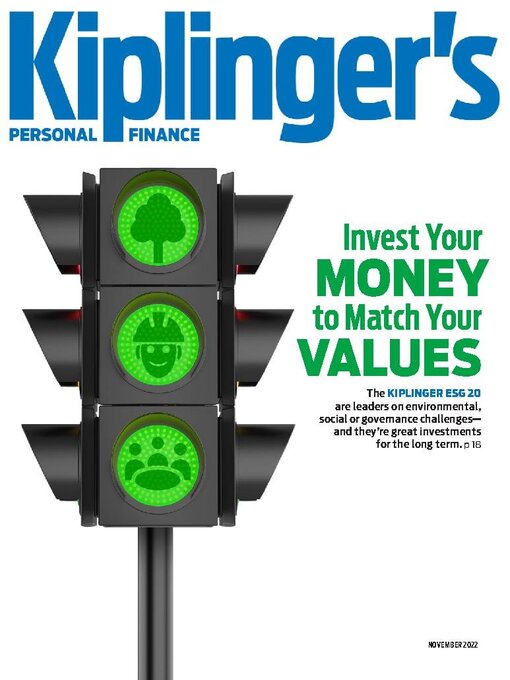

Why We Cover ESG

Kiplinger’s Personal Finance

A STRONG DOLLAR’S PROS AND CONS • A rising greenback benefits U.S. travelers and could slow inflation, but multinational firms may suffer.

FINANCIAL PERKS FOR SERVICE MEMBERS • The armed forces offer educational, home loan and retirement programs even after you serve.

SAVE ON ENERGY—AND ON TAXES • Recently enacted legislation provides a host of tax breaks for energy-efficient home improvements.

BRIEFING • INFORMATION ABOUT THE MARKETS AND YOUR MONEY.

PUT YOUR MONEY WHERE YOUR VALUES ARE • Some of our picks with an environmental, social or governance focus have been bitten by the bear market, but the stocks and funds on our list remain solid choices.

ESG FUNDS

Bond Funds Turbocharge Payouts

How to Invest for a Strong Dollar • U.S. stocks are a good bet—but you have to choose carefully.

New Single-Stock ETFs Come With Plenty of Risk

Don’t Give Up on Developing Markets

A Solid Bond Fund in a Shaky Market

YOUR GUIDE TO OPEN ENROLLMENT • Health care costs have continued to rise, but employers are enhancing benefits for 2023.

Choose the Right Medicare Plan • Before signing up for original Medicare or Medicare Advantage, understand the trade-offs.

A Financial Lifeline for Women

THE ADVANTAGES OF BROKERED CDS

RETIREMENT IS A CCRC RIGHT FOR YOU? • Continuing-care retirement communities provide a range of amenities and health care when you need it—at a hefty cost.

What the Midterms Mean for the Market • The good news is, no matter who wins control of Congress, stocks typically enjoy a nice gain.

The Perks of Filling Out the FAFSA • Even if you don’t think you’ll qualify, apply for federal student aid. You may be surprised.

Good Reasons to Resist BNPL

WHAT TO DO WITH $1,000 • Although the savings rate has dipped again following pandemic highs, many of you no doubt still have ample cash sitting in a bank or money market account. Here are 31 ideas for how to spend (or invest) a cool thousand dollars. Some of the suggestions will bolster your bottom line, a couple are investments in your future, and the rest will raise your fun quotient.

A Doctor Invests in His Community • He runs a clinic for underserved Latino neighborhoods and funds med school scholarships.

Jan 01 2025

Jan 01 2025

Dec 01 2024

Dec 01 2024

Nov 01 2024

Nov 01 2024

Oct 01 2024

Oct 01 2024

Sep 01 2024

Sep 01 2024

Aug 01 2024

Aug 01 2024

July 2024 Double Issue

July 2024 Double Issue

Jun 01 2024

Jun 01 2024

May 01 2024

May 01 2024

Apr 01 2024

Apr 01 2024

Mar 01 2024

Mar 01 2024

Feb 01 2024

Feb 01 2024

Jan 01 2024

Jan 01 2024

Dec 01 2023

Dec 01 2023

Nov 01 2023

Nov 01 2023

Oct 01 2023

Oct 01 2023

Sep 01 2023

Sep 01 2023

Aug 01 2023

Aug 01 2023

Jul 01 2023

Jul 01 2023

Jun 01 2023

Jun 01 2023

May 01 2023

May 01 2023

Apr 01 2023

Apr 01 2023

Mar 01 2023

Mar 01 2023

Feb 01 2023

Feb 01 2023